Health and safety

Potential health & safety risks

These questions could be posed as part of your risk assessment practices:

- Are there any safety risks to the child that should be assessed as in a workplace, e.g. using equipment, extreme heat/cold, training needs etc.?

- Is the child/their property insured if anything were to happen, as home insurance may be invalidated during such 'business activities'?

- How are the working hours (including any staging, learning lines, rehearsal etc.) of the child logged or monitored?

Safety risks and risk assessments

Adam

Adam has been wanting to get some sponsorship money for his football team and is interested in more extreme version of the 'ice bucket challenge'.

Adam asks his dad if he can set up the equipment to record him doing a timed ice bath and he will do it after his football practice. Adam has recently been undergoing tests for ADHD and finds it hard to concentrate on his schoolwork at times.

Edi

Edi's mother focuses on 'healthy and happy' content, with exercise and fitness built in, while her father supports with 'nutty and nutritious' content, making healthy snacks with the girls.

Edi's mother, inspired by a family tv programme, has built a 'ninja training' obstacle course around the back garden, with some equipment supplied by a leading fitness company. Edi's father has been showing the girls how to blend smoothies and bake nutty oat bars to keep them fuelled.

Risk management

Challenges or pranks have become popular types of content on social media and the pressure to perform these tasks and ‘fit in’ may drive children to attempt more risky activities. However, these activities have the potential to go wrong, and there are incidents where children have been severely or even fatally injured.

In contrast, children performing in other industries would have a range of risk assessments conducted in relation to the planned activity, the activity would be conducted with a range of equipment and support to hand, and it would be conducted under the supervision of trained professionals.

In the absence of this risk assessment process and professional support, parents become tasked with the risk management for these activities, which can involve:

- questioning the decision to perform the challenge,

- informing children of the dangers of the activity, and

- supervising them where they show a desire to complete it anyway.

Where planned content involves machinery, equipment, physical tasks, or temperature fluctuations, planning for the activity in advance would involve thorough preparation and explanation of the tasks, as well as consideration of any first aid or equipment needs (e.g. blankets/gloves for cold weather or fans/sunscreen for warm weather).

Insurance

Edi

Edi's mother focuses on 'healthy and happy' content, with exercise and fitness built in, while her father supports with 'nutty and nutritious' content, making healthy snacks with the girls.

Edi's mother, inspired by a family tv programme, has built a 'ninja training' obstacle course around the back garden, with some equipment supplied by a leading fitness company. Edi's father has been showing the girls how to blend smoothies and bake nutty oat bars to keep them fuelled.

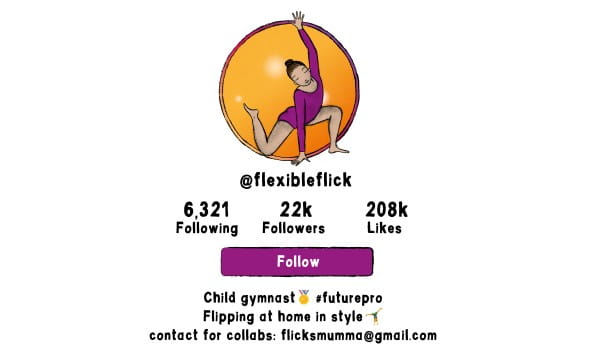

Flick

Flick's parents are very proud of her gymnastics achievements and have even built a small practice area for her in their basement. The content of her reels often shows pictures of her at her house practicing and in her room with her trophies and medals, as well as footage from national and international gymnastics events.

The house is in a very expensive part of town and the content clearly shows a lot of high-value gadgets, electrical goods, and jewellery.

Risk management

Children are insured in every other aspect of their life in case of any harm occurring; in school, at sports clubs, in the shopping centre, or in the car. In any of these places the family would be compensated through insurance for any accidents or injuries that effect the child and their quality of life.

Again, in traditional media formats the brands or agencies would assume responsibility for this, and it would be incorporated into the child performance contract, however this is not the case for influencers, who are classed as self-employed.

Influencer activities are viewed as business activities, which are being conducted within the home, and this might make any home insurance cover for accident or injury invalid. This has resulted in an increase in specific 'influencer insurance', which the independent business owner (parent) would need to take out, in the absence of any brand responsibility to do so.

Influencer content can show a lot of detail about the material goods within a property and there have been incidents where thieves have specifically targeted influencer homes based upon this information.

Again, home insurance may be invalidated under these circumstances, and so it is worth considering ways to manage this (blurred backgrounds etc.) and/or inspect insurance clauses for this information.

Working hours

Adam

Adam has been going to football practice or training most evenings, in addition to his content creation commitments. As Adam is usually running during practice and training, his father struggles to get accurate 'action shots' that are not too blurred or out of focus. This requires additional shots and recordings where Adam looks like he is playing football but he is moving more deliberately, and to direction.

At weekends Adam usually has training on Saturday and a match on Sunday, and in his spare time he plays FIFA on his X-box, which his dad sometimes live streams.

Bea

Bea's mother has received a brand direction for a sponsored 30-second reel, requiring that Bea says 4 lines of script while wearing a certain outfit, using the product, and holding it so that it faces the camera.

Bea is struggling to understand and/or say the words in the correct order and does not know how to say the brand name properly. It takes a few days for Bea to be able to get this all right. During the recording, Bea wants to play with the product and hits it on the ground, breaking the product and making a mess of her outfit in the process.

The content takes 12 attempts to record and edit but, as Bea gets tired and dirty, this has to be done over a few days.

Risk management

Child performers in other industries would generally need to apply for a performance licence for such activities, which would mean that the management of the working hours (and compliance with the performance legislation) would usually become the responsibility of the commercial entity. For example, at the BBC, the Assistant Director and the child’s chaperone share responsibility for the monitoring and logging of these working hours, with any issues being escalated to the Production Manager.

Research identifies that, in order to become a successful influencer, a lot of time is invested in producing quality content on a regular basis and that this labour often does not have any immediate recognisable economic gain. Influencer work can therefore be a full-time occupation for adults working in this industry, so it is important not to have similar working hour expectations for children, who have other external time pressures and also need time to relax and play.

Performance legislation for children in traditional media formats and/or stage performers would include rehearsals and preparations such as costume preparation etc. within the child's working hours. Children performing for social media content may spend lots of time in learning lines, practicing routines, propping and dressing activities etc. While this can be fun and valuable time engaging in family activities, it is also important to consider opportunities to rest, relax and play naturally.

Brands should be aware that the child may not be working solely with them and multi-brand opportunities could increase potential workloads for child performers. Brands should work with parents to have a holistic view of the child's overall brand commitments and manage this workload in accordance with the child's need for 'down time'.

© Copyright University of Essex 2025

Financial