How mentors are helping Malawi’s women entrepreneurs

How a bit of expert advice can help women overcome financial challenges to starting and growing their businesses.

"Most of my working life has involved doing menial jobs in Lilongwe [capital of Malawi] and subsistence farming, and now farming chicken on my own farm. At my age I can no longer do most of the jobs that I used to do. I was hand-washing people’s laundry or cleaning their houses for low pay. I decided to start a business that can support me because I do not have a state pension."

These are the words of Asale Sigele, owner-manager of a poultry farm in Malawi. Born into a large, polygamous and poor family, Asale recalled how she was married off at a young age with no formal education. She has never been in consistent gainful employment, and her husband has now died. She was 56 when she began poultry farming.

Malawi is one of the poorest countries in the world, with 70% of the population living on less than $1.90 a day. Decent jobs are scarce. The United Nations Economic Commission for Africa says women in Malawi are “overrepresented in the most unstable, lowest-paid and lowest-skilled agricultural and non-agricultural work”, coupled with demanding domestic and child-caring responsibilities. An estimated 62% of small business owners in Malawi have only primary-level education or below; 9% have no formal education at all. Yet, women are more likely to be self-employed in Malawi than men: to escape poverty, Malawian women create and run their own businesses.

I met Asale while I was working as a volunteer consultant with Grow Movement, a charity in the UK that provides transferable skills to entrepreneurs in Malawi, Rwanda and Uganda. Grow Movement matches entrepreneurs with a volunteer consultant who works with them for a period of at least six months. Consultants, who are recruited worldwide, are either business professionals or academics, with skills in areas such as marketing, finance, book-keeping and business development.

The book-keeping hurdle

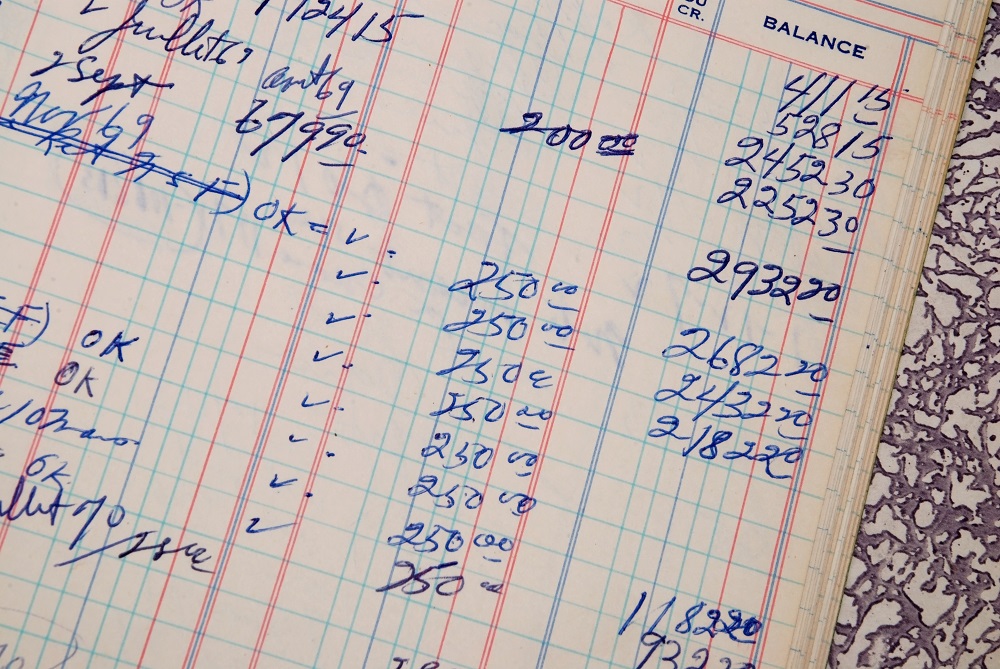

At the start of my consulting journey with Asale, she had been in business for five years and was struggling to expand. During our first meeting, it became clear that she did not have adequate records of her business’s transactions at start-up. The only records she kept were a collection of invoices for chicken feed, poultry medicines and treatments, and equipment. She had a book where she recorded names of individuals and shop owners who took her eggs on credit for repayment later. Everything was handwritten.

Other women entrepreneurs in the Grow Movement programme in Malawi have also shared striking stories. Take Naomi Kuluwani, a 54-year-old woman who runs a grocery shop and a piggery selling pigs to local butchers. When asked whether she kept records of her business’s transactions, she said:

“At first, I didn’t want a teacher [volunteer consultant]: I knew the business, I had been to school. I thought my consultant might give me money, but she was clear that she was not going to give me money, she was going to give me skills to grow. I was just buying and selling. I wasn’t recording anything. I didn’t count anything.”

The Grow Movement case studies are not unique. In a FinScope study on women entrepreneurs in Malawi, 65% of small business owners lacked financial records. In the study, a woman entrepreneur explained how “access to finance is a challenge because banks require collateral, deposits or savings, adequate financial records, written business plans and credit history. They charge high interest rates and have short loan repayment periods.”

What’s more, the study notes that most properties are owned by men, with the result that women who use their husband’s name to demonstrate existing capital as collateral can also be affected by their husband’s adverse credit history, which might require his wife to repay the debt or be denied credit.

As someone who teaches and researches accounting, I could see that financial record-keeping was a major challenge in women’s entrepreneurial journeys in Malawi. We developed a tailored plan for training and mentorship to help Asale to address these challenges. We started with basic book-keeping training and then moved to the basics of preparing a profit and loss statement.

Because of Asale’s limited formal education, we used lay language such as ‘left-hand-side column’ or ‘right-hand-side column’ when referring to the record of expenses and revenues. Asale would then tally the totals for each column on a weekly basis to estimate her weekly profit. Those totals would be aggregated to determine the monthly profit from the poultry business. She would keep the records in her native language of Chichewa, which is widely spoken in Malawi.

Controlling costs

Without a clear strategy for financing and controlling costs, even viable businesses will not survive whatever their early successes at start-up. Asale and I identified three areas of focus for growing her business. First, the sale of eggs and ‘aged chickens’ that had ceased to lay eggs. We mapped the city of Lilongwe into households, local grocery shops and a supermarket as key customers, and she identified five businesses as being the main competitors in her locale. One particular pinch point was egg hatchery and sale of chicks, which her neighbourhood specialised in. Asale had to place orders up to six weeks in advance if she intended to buy new chicks. Acquiring an egg incubator would allow her to produce more chicks, which in turn would increase egg hatchery – a potential avenue for expanding her revenue stream.

This brought us to the second focus area: obtaining working capital financing. Asale had an outstanding loan which she was struggling to repay. The main reason was that she had bought 1,300 chicks with the loan but 400 had died within weeks. This had reduced her profit margin and stretched her loan repayment period, and she could no longer use her existing chickens as collateral for a new loan. We had to identify alternative financing.

We agreed that she should approach vendors that were selling egg incubators – poultry-hatching equipment – and acquire one through hire-purchase arrangements. A solar- or kerosene-powered incubator was ideal, considering the frequent power outages in Malawi. The hire-purchase arrangement was more costly than a secured loan and we thus agreed to approach a microfinance bank for funding using the incubator as collateral. She did not go to a commercial bank, as this would be costlier.

Asale already participated in a ‘merry-go-round’, an informal table banking system where individuals come together to lend money to each other on a rotational basis. Unfortunately, the merry-go-round lacked capacity to pay for the incubator.

Third, Asale had lost over 30% of her brood to a suspected infection. She clearly needed insurance cover. We found out that the microfinance bank that provided the egg incubator loan also provided insurance to small and medium-sized enterprises. This would also minimise losses if her chicks died due to infections or environmental factors. So she got one insurance policy for the chicks which hatch from her incubator and another for any newly acquired chicken which forms part of her egg-laying flock.

Fourth, control of business expenses. Asale had relied on memory to identify the various costs incurred in the poultry business: chicken feed and medicines, kerosene to keep young chicks warm at night and casual labour when egg yield was high. Chicken feed was the highest expense.

We tried two ideas. First, visiting shops and comparing the various prices with the egg yield they produced. We reduced the price she paid for feeds by 5,000 Malawian kwacha ($6.15) per kilogram. Though feed does not appear expensive, for a small business in Malawi it be the difference between making profit and operating at a loss. Asale knew out of experience that changes in nutrition can cause a drop in egg production, so we agreed to buy smaller quantities of the new feeds in order to be able to study their effect, mixing with the previous feeds to create the blend of nutrition that would maximise egg production.

Second, a 50/50 base mix of poultry concentrate and corn that offers chicken nearly the same benefits as standard feeds, but at a lower cost. This was considered because she had ample space to plant more maize to feed the chickens in a 5.6-hectare farm she had inherited from her late husband. Taking both measures together, we agreed on the 50/50 mix as it helped to reduce the operating costs of feeding the chickens by approximately 40%.

The way forward

Asale and I collaborated by combining her local knowledge with my expertise to overcome some of the main challenges that she faced and enhance the efficiency and profitability of her fledgling business. Her local knowledge of issues on the ground and my skills as an accounting and business educator allowed us to identify solutions.

A survey of small businesses in Malawi reports several schemes to help access to finance and basic business skills, such as Growth Accelerator Market Test Programme, Private Sector Development Programme and Jobs for Youth Project. Despite these, access to finance remains the number one challenge facing women entrepreneurs in Malawi. Nor are essential financial literacy and numeracy skills widespread enough to enable women entrepreneurs to effectively use available funds.

The success of Asale means that she can serve as a role model for other women. The National Association of Business Women Malawi should consider initiating nationwide mentorships, pairing women micro-entrepreneurs with experienced owners or managers of established businesses. A locally driven support network has been demonstrated to be useful, especially for women of Asale’s age who no longer have the time to enrol in formal education.

The Malawi government, through the Small and Medium Enterprises Development Institute or the Development of Malawian Entrepreneurs Trust, should designate SME support officers to partner with field officers who work for organisations such as Grow Movement. The SME support officers’ provision of near-customised support can help sustain the time-limited mentoring that I was providing as a volunteer mentor.

Without these local interventions, internationally backed schemes will continue to attract scepticism and we will continue to see women struggling grow their businesses to the same extent as men.

This article was first published in openDemocracy under a Creative Commons Attribution-NonCommercial 4.0 International licence and the original can be read here.

Cover image credit Shutterstock