Will Trump or Biden win the US election? This could be a better predictor than the polls

Joe Biden, the Democratic challenger in November’s US presidential election, has finally picked his candidate for vice president: Kamala Harris.

Has picking Harris, who is Black and Asian American, improved Biden’s chances of winning the election? Or has it actually improved the chances of Donald Trump to get re-elected?

Depending on who you ask, the answer can vary significantly and an objective answer is hard to come by. Polls or approval ratings could help – the latest poll aggregation puts Biden in the lead with 50% versus 41% for Trump with the rest of voters undecided.

But prediction markets, simple financial markets where the value of the traded assets depends on outcomes such as who wins an election, have been shown to be better longer-term predictors of election outcomes. Anyone can trade in these markets and firms can also use them to insure against political risks. Some companies even use prediction markets to forecast political changes, the demand for new products or the feasibility of project deadlines.

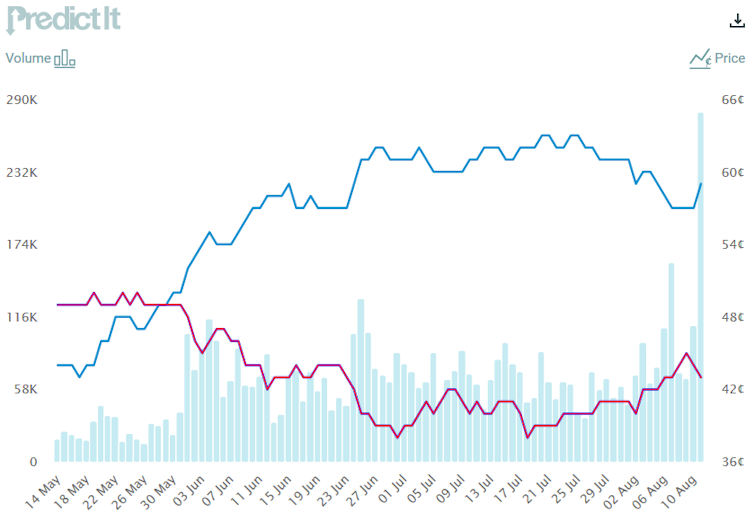

Biden’s chances of winning the November election were given a boost on prediction markets when he announced Harris as his running mate.

How prediction markets work

Prediction markets operate in the currency of the country in which they are based, say for example US$. For the US election, markets trade a Trump-asset, which pays out $1 after the election if Trump wins, and $0 otherwise. The Biden-asset pays out $1 if Biden wins, and $0 otherwise.

Prediction markets always price these events between $0 and $1. This means the price of an asset can be interpreted as a probability of an event occurring. So if the Trump-asset trades at $0.4, then Trump has a 40% chance of victory. It does not mean that “Trump is going to lose the election” – it means he is the underdog and will probably, but not certainly, lose. And the market quantifies these chances. However, whatever the market price, the investor will still either get only $1 or $0 after the election results are announced.

If most traders think an asset is overpriced, because the price exceeds the candidate’s chances, then they will sell and the market price will drop. Conversely, if most traders think an asset is underpriced, they will buy and the price increases. So, the market prices are a prediction of the election outcome based on the wisdom of crowds, a consensus forecast that tends to be better than the forecast of single experts.

We know that prediction market prices match the underlying probabilities because empirical and lab research has looked at thousands of such market predictions, grouped all with a price of $0.4 together, and found that the predicted event underlying the asset, for example, the election of a particular candidate, did indeed occur in 40% of these cases. Similarly, for prices of $0.5, the underlying event occurred in 50% of cases, and so on. The prices are well-calibrated as probability forecasts.

Trump’s chances

The biggest prediction market about the US election, which is based in New Zealand, predicts a 41% chance of Trump winning the election, and Biden is a strong favourite at 59%. On August 11, the day of the Harris VP announcement, Biden’s chances jumped by two percentage points while Trump’s dropped by two.

The market clearly thinks Harris was a good choice and increased Biden’s chances of winning the election. This day was also the day with the highest trading volume in the past few months, making it one of the most important events in the campaign.

Before that, the price graph shows that Trump’s chances slipped considerably in June. In early May, the market still viewed Trump as the favourite, with Biden not impressing during the Democratic primary race. But since the dual crisis of the COVID-19 pandemic and Black Lives Matter protests (including Trump’s reactions to them) became the main issues in US politics, Trump has been losing ground steadily, and Biden overtook him as favourite.

Which events led to this reversal? On May 28, Trump threatened to bring in the National Guard to confront Black Lives Matter protesters, using the widely criticised “when the looting starts, the shooting starts” quote, prompting Twitter to flag the tweet as “glorifying violence”. On June 1, protesters were dispersed by force so that Trump could walk to a church for a photo-op. Prices at that time show that within just a few days, Trump lost about five percentage points while Biden gained five, changing the difference by ten percentage points in favour of the challenger.

COVID news also had a significant impact. On June 24-25, Trump lost another four percentage points, widening the gap to Biden by eight. During these two days, Anthony Fauci, director of the US National Institute of Allergy and Infectious Diseases testified that the US has a “disturbing” surge in new cases, showing the US was not dealing well with the crisis. In late July, Trump recovered a few percentage points as attention shifted slightly to his anti-China rhetoric and the sale of Chinese social media platform TikTok.

But the race is not over. In the 2016 election, prices moved the most in the two months just before the election. Trump trailed Hillary Clinton in prediction markets throughout the campaign and was seen as favourite only on election day – showing that the underdog can recover. So despite Trump’s poor position now, he might still regain some ground.![]()

Christoph Siemroth, Lecturer in Economics, University of Essex

This article is republished from The Conversation under a Creative Commons license. Read the original article.